Top 10 Reasons to Invest in Philippine Real Estate

Investing in real estate is an attractive option for many people who want to build their wealth. It offers the potential for high returns on investments that provide income or appreciation. Below, we offer 10 reasons real estate makes sense as an investment.

1. It Can Provide Stable Cash Flow

One of the biggest reasons to invest in real estate is that it can provide a steady stream of income. Unlike stocks which fluctuate with the market, real estate is more stable and predictable.

For example, if you purchase an asset such as a house and have chosen good tenants, you can receive recurring, predictable rental payments.

2. Passive Income

Owning a property for rent or lease can provide you with a good monthly income that is not as demanding as a traditional 9-5 job. Some people avoid real estate because they think they have to be good at fixing plumbing issues and troubleshooting appliances.

Let's bust some myths

- If something breaks, you have to fix it yourself. False!

- You have to renew tenant leases yourself. False!

- You have to find new tenants yourself. False!

- You have to take tenant calls and complaints yourself. False!

- You have to cut the grass yourself. False!

Fact: You can delegate some or all of the work to contractors or hire a property management company to take care of it for you. If you find a tenant who pays their rent on time and does not cause too much damage to the property, then you should be fine.

By hiring someone else to manage your property and periodically increase rents, you can focus on other aspects of your life. This frees up your time so you can spend it surfing in Baler.

When set up correctly, you'd just need 20 minutes a month to analyze income and expense reports from your property manager, then another 10 minutes to send these to whoever files your taxes.

The amount of money generated from passive income varies depending upon how much up-front work you put into the property. Most landlords choose to maximize their profits by renting their units at full capacity.

3. Diversification

Diversifying your portfolio by adding real estate can help protect against losses in one area of your investing portfolio. For example, if you own stock in a company that goes bankrupt, you may lose all of your money. However, if you also own real estate, you could still make money even though the value of your shares declines.

If you're an international developer, you can bring a foreign eye to provide premium products for expats from your region, with features those in the Philippines might not prioritize.

Investing abroad is risky, but so is having all your investments tied to one nation's currency and economy. You must decide whether the risk of loss from the collapse of your country's economy, especially if its real estate market highly depends on debt, outweighs the risks of exposing yourself and your family to a new culture.

If you think your domestic property is in a housing bubble, you can release equity to buy a property in the Philippines.

4. Real Estate Helps Protect You Against Inflation

Real estate is always going up in value. As inflation rises, this translates to higher property values and lets you charge a higher rent, increasing your income as a landlord.

Because of this, real estate income is a great way to hedge your investment portfolio against inflation.

5. Illiquidity

A house or condo is often harder to liquidate than other types of assets, like stocks and bonds. This means you can't easily sell your property when you want to access your capital quickly.

The illiquidity of real estate is an advantage because it provides the stability that most traditional investments lack. For example, it protects investors from short-term fluctuations in market rates. Buildings and land don't trade quickly and that makes them less volatile.

Liquidity in stocks, for example, is a disadvantage because it can lead to short-term volatility. It’s difficult to know when you will be able to sell your stocks and make a profit.

Unlike stocks, people who invest in property don’t need to worry about the asset decreasing in value overnight if another recession hits. This is especially true if your investment is a commercial multifamily apartment, which may see increased demand as people look for lower-cost housing.

6. Leverage

Leverage is borrowing money to purchase an asset that will generate income. It uses someone else's money to buy something of value.

For example, if you want to buy a PhP 2,000,000 property but only have PhP 400,000, you can take out a mortgage loan for PhP 1,600,000 to cover the rest. You lock in the price at this level instead of trying to save up enough to buy the PhP 2,000,000 property in cash, which might take so long that its market value will have increased further and become unaffordable.

This isn't something you can do with an asset like stocks, for example, because banks typically wouldn't lend you money to buy stocks [1].

If you're paying a lower interest rate on the loan than you're getting from the investment, leveraging will increase your profits. For example, if the rate of return on the investment property is 7%, and the interest rate on the loan is 5%, you'll earn the 2% difference from the lender's money.

7. The Philippines is a Rising Economy

The Philippines is flourishing. Except for 2020, the country's GDP has grown at an average rate of 7% every year. Its average GDP growth in 2021 is 4.9% as of September, and the current administration expects it to increase to 6.4% in 2022 [2].

International tourism grew consistently until the 2020 pandemic, and analysts expect it to continue once the country has recovered. Not surprising, given its world-famous natural wonders.

As of January 2022, 45.9% of the country is fully vaccinated against COVID-19. The vaccination rate has been increasing thanks to efforts like a vaccination drive in late 2021.

The Philippines is a world leader in business process outsourcing (BPO). Because of the IT-BPO sector's ability to weather the COVID-19 pandemic, it expects to generate $29 billion in revenue and create 130,000 new jobs by 2022.

Other major contributors to its growth include remittances from overseas Filipino workers (OFWs), the shipbuilding industry, and exports such as semiconductors, machinery, and transport equipment.

Historically, the Philippines' economic and social growth has lagged that of its more prosperous neighbors. But times have changed. It now ranks among Southeast Asia's fastest-growing economies.

8. Property Values Appreciate Over Time

As global firms continue to outsource their business processes to the country, demand for office space has increased. Despite rising land values across Metro Manila, its rental spaces are among the least expensive in Asia Pacific.

With more Filipinos looking to work or study from home, the demand for affordable homes outside central business districts will only increase.

These factors, combined with a growing population, help ensure the appreciation of property values.

9. You Can Save on Taxes

Sellers of real property pay a 6% capital gains tax, but if it's the sale of your own principal residence, you may be exempt. For a PhP 2,000,000 property, you'd save PhP 120,000 (US $2,367) if you meet the requirements.

If you're from the US, you can own a condo without having to report it to the IRS as an asset [3], though rental income still needs to be reported and is taxable.

10. The Philippines is One of the Most Affordable Countries in Asia

Buying a house in the Philippines is much less expensive than buying a comparable house in many of its neighbors. If you're a foreigner looking to live overseas, you'll love its low cost of living, whether in Manila or other cities.

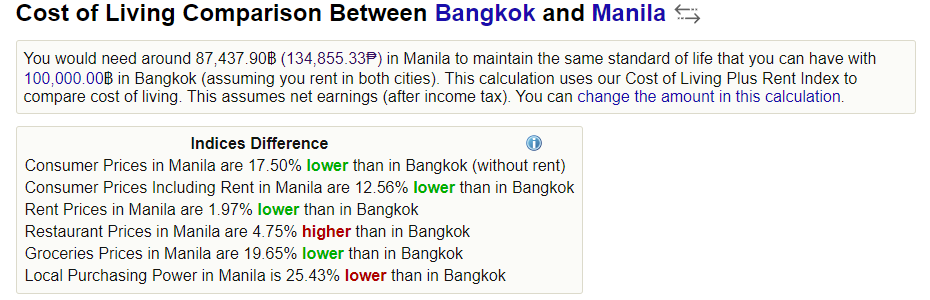

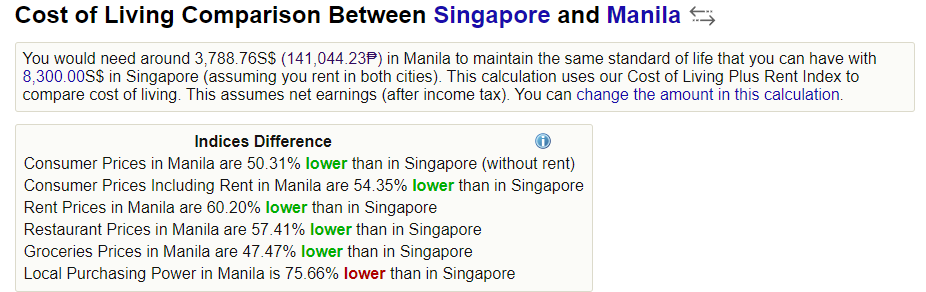

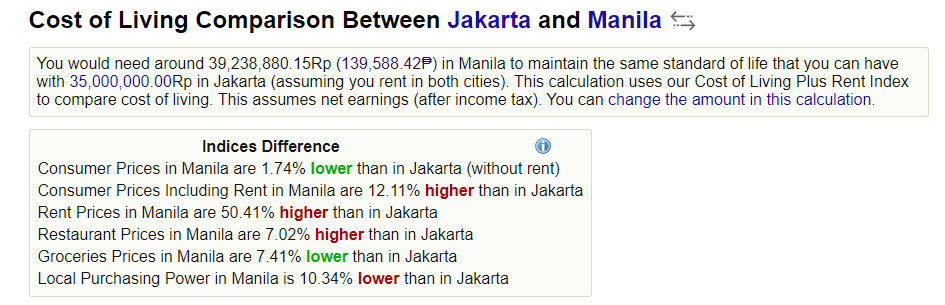

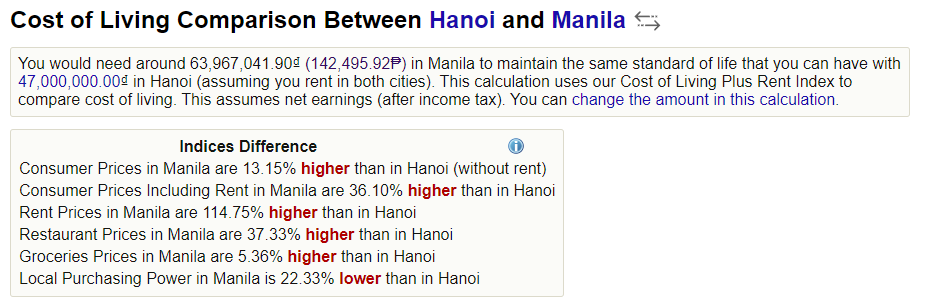

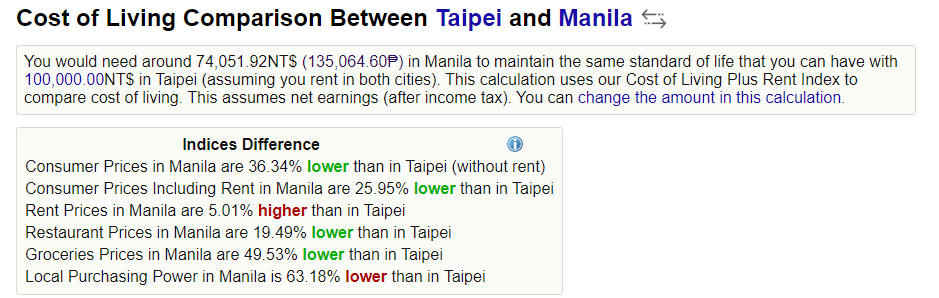

Below are some comparisons between Manila and other capitals as of 2021, from Numbeo. Although the local purchasing power isn't ideal, this isn't an issue if you're practicing geoarbitrage, which means earning an income in a strong currency like euros, dollars, or pounds and spending it in a country with a lower cost of living.

Bangkok

Singapore

Jakarta

Hanoi

Taipei

Conclusion

Most millionaires have multiple sources of income. But even if you're not trying to get filthy rich, it's no longer safe to rely on one source of income, whether it's one job, one kind of asset, or one country. That might have worked for your grandparents 50 years ago, but today's accelerating change demands a new mindset.

By investing in real estate in the Philippines, you future proof yourself. You balance your income sources so that no single one dominates, minimizing risk.

Oh, and did I mention its amazing tropical climate? 🌴🥥🥭

[1] You can still borrow through leverage trading if you understand the risks.

[2] https://www.bworldonline.com/phl-likely-to-be-asias-economic-laggard-in-2022/

[3] This article does not provide tax advice. You should always consult a tax professional when making decisions based on information in this article.